At a recent public hearing, Giovanni Silvagni took the stage to passionately advocate for the beloved Fresh Pond Road Italian Festival, emphasizing its deep roots in the Ridgewood community. He highlighted how the four-day event brings families together, supports local businesses, and showcases the neighborhood’s vibrant culture. […]

Read more →Giovanni P. Silvagni has been appointed an officer on the Board of Directors of the Patronato ESPASA-ITACO. This esteemed organization serves as a vital link between Italian citizens abroad and their homeland, providing government and social services to the local Italian community. Giovanni’s appointment brings an exciting […]

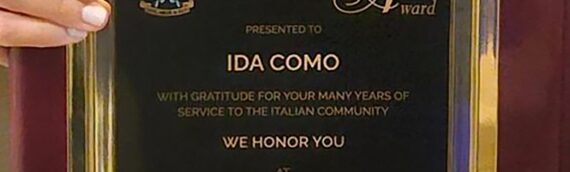

Read more →The Castellamare Del Golfo USA Club has recognized Ida Como with the prestigious 2024 Humanitarian Award. This honor celebrates her exceptional contributions to her community and her dedication to preserving Italian-American heritage. Born and raised in Williamsburg, Brooklyn, Ida’s journey is a testament to hard work and […]

Read more →Join us for an informative presentation about Pre-Planning and Wills. When & Where: Sunday, May 19th, 2024. Immediately after the 12 noon mass at St. Francis Church in the St. Francis Lyceum. A light lunch will be served! Address: 219 Conselyea St, Brooklyn, NY 11211 We are happy to […]

Read more →The Medicaid Asset Protection Trust (“MAPT”) is a common trust used in New York which begins the process of protecting assets from long term care expenses (such as nursing home and home care expenses), avoiding probate, all while maintaining all relevant tax benefits such as the stepped-up […]

Read more →We’d like to take a moment to congratulate Ida for receiving the Woman of the Year Award from the Associazione Culturale Italiana di New York. We thank the Association for recognizing all of Ida’s had work and dedication to not only the Italian American Community, but to […]

Read more →Our main goal is to protect the wishes and assets of senior citizens.We ask that you trust us, a family owned business, to help you feel safe and protected with your assets that you worked so hard to get. Watch our latest installment on Sandel TV. We […]

Read more →Our very own Ida Como was recently sworn in as the new president of The Columbian Lawyers Association in Queens County. We’d like to congratulate Ida on her newest accomplishment! All of us here at Silvagni & Como know she’s the perfect candidate for the job because of […]

Read more →Contrary to popular belief, family members do not have an automatic right to make decisions for an incompetent person. A Guardianship is a court proceeding in which the Court appoints a person to manage the affairs of a person who is incompetent or unable to handle their […]

Read more →It is well established that living trusts are a good estate planning vehicle. Living Trusts can be used to achieve most of your estate planning goals. Trusts can be used to minimize estate and income taxes, avoid probate, and protect assets from Long Term Care Expenses such […]

Read more →